How to Use the

ONUS Membership Card

Card Issuance Process

- From the main screen in the ONUS app, scroll down to “Features”, tap “More”, and select “ONUS Membership Card”

- Tap “Create Card Now”

- Fill in your personal information as required

- Confirm that you have read and agree to the Terms & Conditions

- Tap “Submit Request”

After submission, your application will be reviewed within approximately 30 minutes. You will receive a notification once the card is successfully issued.

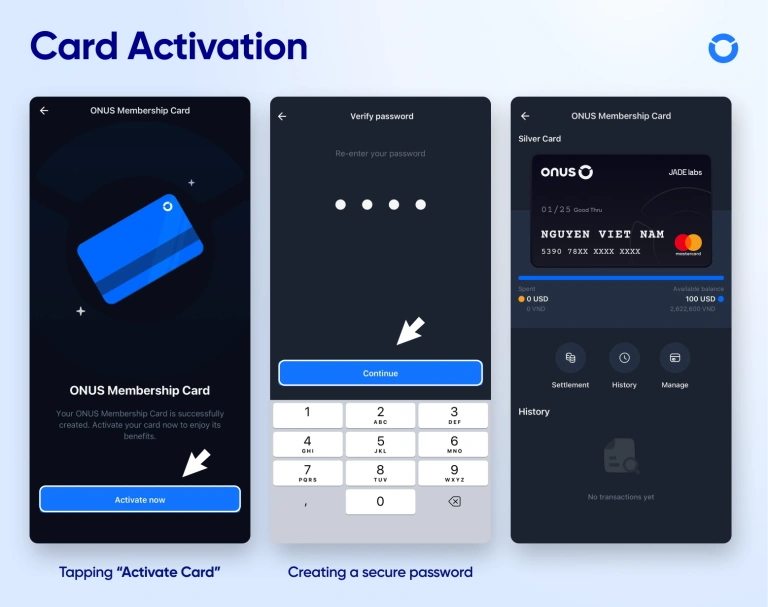

Card Activation

Once issued, activate your card by:

- Tapping “Activate Now”

- Creating a secure password – this will be used for transactions and to access card details

Upon activation, your card will be immediately credited with a $100 spending limit, and all ONUS Membership Card features will be available.

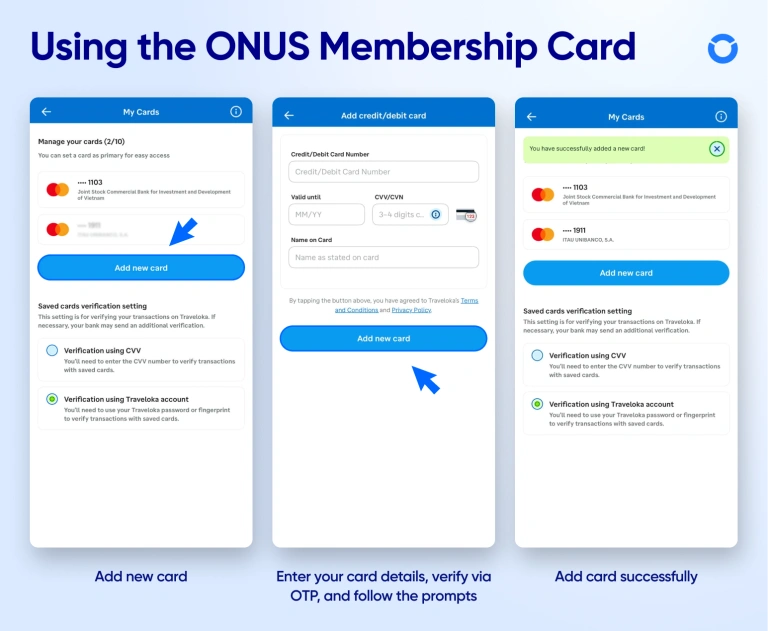

Using the ONUS Membership Card

To use your ONUS Membership Card on online shopping or service platforms, simply follow these steps:

- Go to the website or app of your chosen service, such as Shopee, Grab, Amazon, etc.

- Look for the “Add Card” section. Select Add New Card.

- Enter your card details. Verify with the OTP and follow the required steps, just like adding any other regular card.

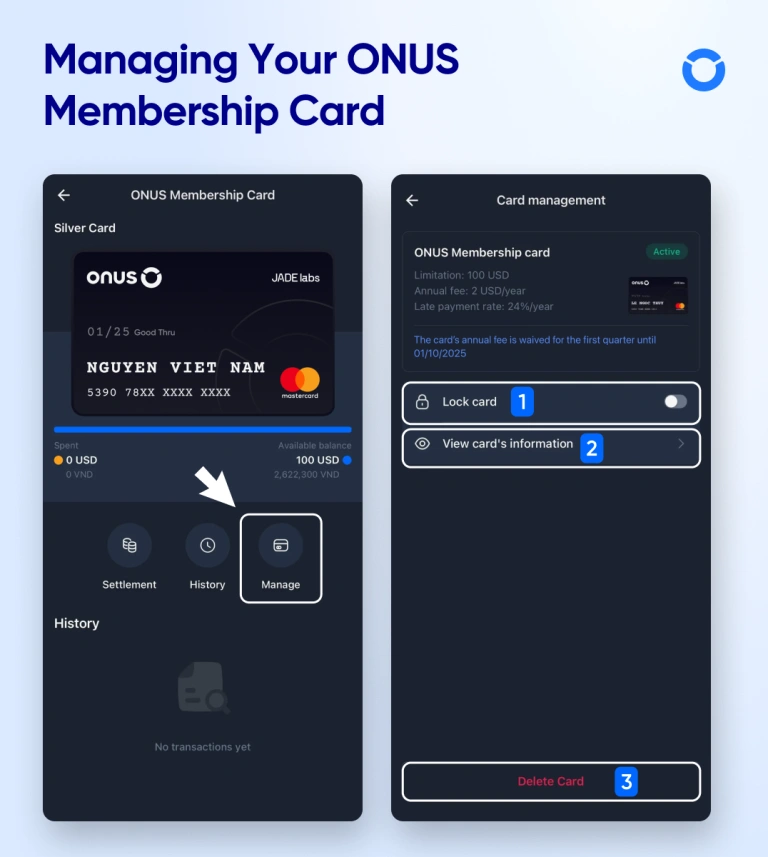

Managing Your ONUS Membership Card

From the main card screen, tap “Manage Card” to:

- Lock Card: When the card is locked, it cannot be used for spending. You can unlock the card at any time.

- View Card Information (card number, cardholder name, expiration date, and CVV/CVC): For security purposes, you will need to verify your face/fingerprint or enter your authentication password to view card details. Do not share your card information to avoid the risk of losing assets.

- Delete Card: You must settle all outstanding balances before permanently deleting your card. Once the debt is fully cleared, please submit a deletion request via ticket for ONUS support.

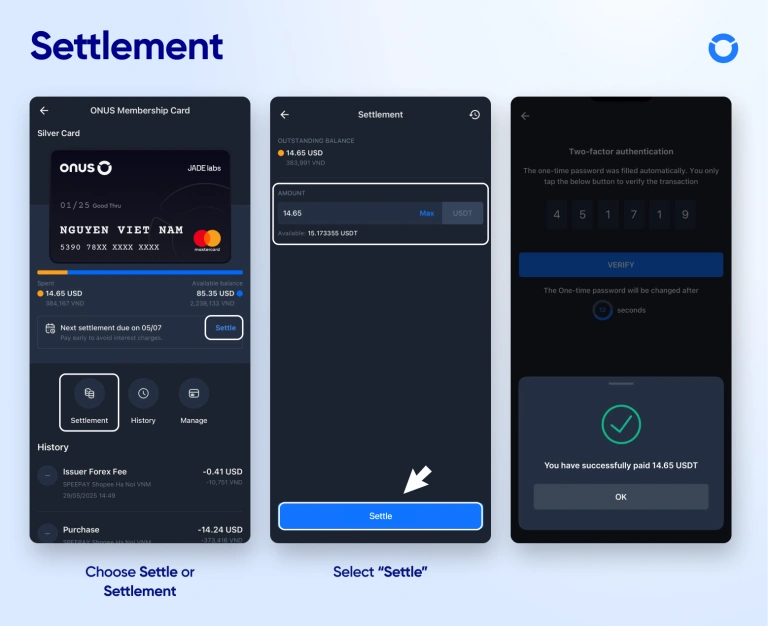

Settlement

The total outstanding balance from the previous billing cycle is finalized at 00:00 AM (midnight) on the 20th of each month. You must settle the outstanding amount no later than 00:00 AM on the 6th of the following month, using USDT directly within the ONUS app.

To make a settlement:

- On the main screen of your ONUS Membership card, tap “Settle or Settlement“.

- Proceed to make your settlement in USDT.

Late Settlement Fee Calculation

If your settlement is overdue, a late settlement fee of 24% per year will be applied. The fee is calculated based on the overdue amount and the number of late days.

Late Settlement Fee Formula:

Fee = Total outstanding amount × (24% / 365) × Number of overdue days

If you complete your settlement before 17:00 UTC on the 5th, no late fees will be charged. If you settle after midnight on the 6th, late fees will be applied as follows:

- If you settle the full balance, the late fee is calculated from the previous cycle’s cutoff date (17:00 UTC on the 19th of the previous month).

- If you make a partial settlement, the late fee on the remaining balance is calculated starting from the day after the partial settlement.

For example, if you make a partial settlement on July 6 (UTC), the remaining balance will start incurring late fees from July 7 (UTC).